by Puya Chamer

Founder & CEO | Counos Blockchain Industry

--------------------------------------

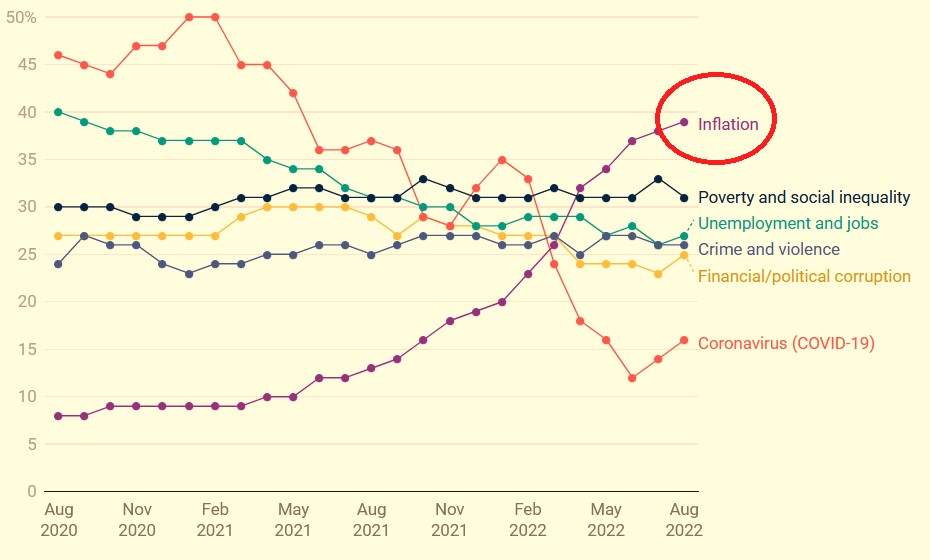

According to the latest research from October 2022, the number one universal concern that is shared most by people is concern over the global economy[1] and modern financial crises, such as inflation.

In fact, in this research, a whopping 42 percent of the global community believes that inflation is the biggest problem facing their country.

That huge number is almost half of the people. So, half of the people on earth are concerned over inflation and their country’s economic status. What is the main source of this concern? A major contributing factor is the loss of faith in conventional financial institutions, because when the time came they failed to perform as they should have.

There are, sadly, no shortage of examples; the Venezuelan Bolivar depreciated about 90% against the US dollar in the last couple of years only; the same is true for Iranian Rial, Egyptian Pound, Ghanaian Cedi, Japanese Yen, Lebanese Pound, and even Euro have all been going through the motions, among many others.

I touched upon this issue in a previous article that:

But what is this way out?

As specified in the above mentioned article, a pathway forward is to use gold as a vehicle for the transfer of value and build around it an intricate and comprehensive financial system to value transfer.

A crucial part of this apparatus is the Lender.Gold section.

Banking System Based on Gold

In order to combat the serious issues related to inflation and the depreciation of the value of fiat money, countries need to turn to a new banking system that is entirely based on gold.

If gold is to be regarded as the new vehicle for value and the transfer of it, then it would only be prudent to conceive of a new banking system that is run based on gold, as its main currency.

In this way, gold can potentially and feasibly replace the fiat money of different countries as the main currency. This fact could especially prove beneficial for countries whose fiat money is in shambles. And with a quick look around the world, we can find many that are in this situation.

In this new system of banking, countries would stop lending and borrowing fiat money all the time – especially fiat money. Because countries are building up higher and higher volumes of fiat money debt.

Countries can lend gold instead of fiat money, because in this case, they can also get back gold. They can also borrow gold from this gold lender system that is proposed. And last but not least, governments and countries can use up their unused sources of fiat money, sources which are usually just gathering dust, and purchase gold with them, which can then be lent back into the system, and it goes again and again, gold goes, gold comes back.

One of the most important feats that is accomplished with this new banking system is the prevention of exchange of a country’s national currency into another country. Because as it stands, we see that national currencies, especially of less industrialized and less developed countries, into other fiat money and currencies. But with this system, the value of the national currency of countries can be preserved and protected.

The biggest advantage of this banking system that is built around gold is that it takes a lot of control out of the hands of bad players in the system. What this means is that people, institutions, and governments can no longer issue money over abundantly. Because the finite resources of physical gold can act as reasonable restraint to control the issuance of currency. This way both inflation and deflation that can be present with a fiat money system can be avoided.

---------------------

[1] https://www.ipsos.com/en-uk/what-worries-world-october-2022