Abstract

One of the main reasons of innovations and development of Blockchain technology has been facilitating and altering the industry of financial transfers. The very high fee of financial transfers in the traditional systems and also management focus or state and political control are not consistent to the increasing growth and new values of global financial markets. Due to its decentralized structure, Blockchain offers many advantages for developing the industry financial transfers. The possibility of creating transparent transactions, suitable speed for macro-financial transfers around the world and avoiding bureaucracies related to the concentrated state and political managements are among the most important positive points about Blockchain technology in developing financial transfers. Despite such positive features, one of the biggest challenges in using cryptocurrencies for financial transfers is the instability in their values. Moreover, the lack of a comprehensive system to change cryptocurrencies to different types of fiat money has been trouble making too. Counos platform has been developed to answer these problems. Counos intends to extend its own financial transfer system through offering a wide spectrum of stablecoins and also creating an appropriate solution in developing a decentralized exchange for trading and transferring cryptocurrencies all across the world. Traditional resistances against Blockchain have not yet neutralized and it accounts the development of the index of trust for a new technology to fit in all around the world. Blockchain still needs a rich extension of its trust among its users. The result of extending the trust in Blockchain will be the dominance on the critical indexes of financial transfers and digital assets around the world.

Introduction

Bitcoin can be the very first step of giving birth to the cryptocurrencies, but the Blockchain technology which is behind this cryptocurrency is something bigger and more extensive. From Blockchain 1.0 to Blockchain 2.0 to which smart contracts were added, it faced very big changes in a relatively short time. Gradually Blockchain entered many various fields. Financial transfers and digital assets have been one of the most influential reasons for the innovation and development of Blockchain technology and it might be said that at least for many, the changes in Blockchain technology in the field of financial transfers and keeping digital assets are among the most critical reasons of using Blockchain technology (Schueffel, Groeneweg & Rico, 2019). Some believe that Blockchain can make an evolution as big as the internet in the industry of financial transfers (Tapscott, 2016).

Blockchain is now much more beyond a digital payment system and it can be the Internet of Money in the future too which joins financial assets to each other. Just like what the Internet of Things (IoT) does via connecting different electronic devices and tools, through lowering the transactions charges, cryptocurrencies can be highly beneficial for the economy especially in the market of international 514-billion-dollar bills which include the transaction fees from 7% to 30% of transfer charge. In fact, it might be acknowledged that one of the most important reasons of the success of cryptocurrencies has been the decrease of a transfer fee of financial assets (Huang, 2018).

Cryptocurrencies are not only a better replacement for the visa card or master card, but they also can help us do more tasks than traditional methods of money transfer. Cryptocurrencies which were introduced as Blockchain in the first version are just a simple schema of what Blockchain does in the field of the financial transfer. Bitcoin was changed into a type of programmable money in the second version of Blockchain (Swan, 2015).

The challenges we encounter in the field of financial transfers are versatile. Although traditional methods of transactions are still responsive to most the people's needs, there are some gaps in this ground such as financial focus, lack of transparency in financial transfers and also the dominance of the governments to develop fiat money which can be filled with the help of Blockchain in the future.

The presence of Blockchain has resulted in dramatic positive consequences for the financial transfers considering its decentralized and transparent structure. Clearing and paying fast, transparency in payment, increase in trust level in payment system considering the decisiveness of transactions and the decrease of financial frauds by a central financial management and of course developing the structure of authentication to make more sure about the health of financial transfers are among the most important benefits of Blockchain technology for the industry of financial transfers (Mulders, 2019).

With the deconstruction of Blockchain technology, other fields are using Blockchain in the traditional payment methods. For instance, PayPal was first a creative payment method that continued working out of traditional methods; however, though it found a more regulated form in time and collected its clients' information. PayPal is currently using Blockchain technology. It announced in 2014 that it would cooperate with three well-known platforms; i.e., BitPay, Coinbase, and GoCoin. Furthermore, it was working on a new feature in that year by which its clients would be able to pay Airbnb and Uber charges via Bitcoin (Swan, 2015).

But the effect of Blockchain on the financial field can even lead to better access of the people in the developing countries to the financial services. According to the statistics, about half of the people in developing countries gain access to the internet. On the contrary, 1.7 billion don't have bank account all around the world (Felsenthal & Hahn, 2018).

Blockchain can assist the people in gaining equal access to the bank account and financial payment to those who don't have a bank account. Moreover, financial corruptions which are mostly created due to the existence of a central system can be deemphasized through it.

However, the financial systems have not yet been able to create an all-in-one financial platform to aggregate all Blockchain technology equipment for the financial transfers. It has different reasons the most important reason whereof has been the lack of disseminating an appropriate standard for financial platforms of Blockchain (Saigal, 2019).

Counos platform has been developed to fill the gaps resulting from lack of an all- in-one financial platform of Blockchain in the field of financial transfers. Counos is a platform in the field of cryptocurrencies and Blockchain-based payments which has offered a relatively comprehensive solution for the online payments. One of the biggest problems related to cryptocurrencies for financial transfers has been the instability in their value in recent years. The value of cryptocurrencies was sometimes changing to multiple times in a few months. It made serious worries in transferring assets. For getting rid of these problems, stablecoins or cryptocurrencies with a stable value were created and developed. Counos uses its various stablecoins comprehensively. The stablecoins with a value equal to that of valid fiat currencies such as Swiss franc, U.S. dollar, Canadian dollar, and Euro. Through offering a wide variety of stablecoins, Counos attempts to meet the needs of different financial markets for financial transfers.

Lack of an all-in-one system that can accelerate and guarantee buying and selling cryptocurrencies in addition to offering them has continuously been challenging. In addition to offering cryptocurrencies based on Litecoin algorithms like Counos Coin and of course various stablecoins, Counos platform can offer similar services to Western Union all across the world. In fact, Counos decentralized exchange offers the users the possibility of trading different kinds of cryptocurrencies and stablecoins with fiat money all around the world. Moreover, Counos provides the users with online purchases through offering a comprehensive gateway based on cryptocurrencies (Cridland, 2018)

Offering all varieties of financial services on the infrastructure of Blockchain, Counos is trying to meet the users' needs in an all-in-one platform besides filling the gap of trust.

Despite all the advantages this Blockchain-based financial systems has comparing to their competitors, the issue of trust has not still been solved for many people. There are many opinions in this regard, some believe that a new method of trust has been created, some others believe that a totally distributed system cannot be a reliable source. The challenges ahead of the financial field and the solution Blockchain has for it are important questions that will be discussed about more in the following parts.

1.1 Evolution in the Financial Systems of the World

The financial systems of the world have dramatically changed in time. With the advent and more emphasis on the banking, the banking systems have become more concentrated. It has had a big advantage for a small portion of the people in the world and in fact most of the liquidity is directed and regulated by these organizations and people. In a report in 2015, The Economist claimed that the ledgers which don't require to be controlled by the states or the organizations will cause changes in the structure of the governments and organizations in time (Davidson, De Filippi & Potts, 2016) Concentrated financial systems have high costs, the financial systems have continued their job so far, but in many cases (e.g. developing countries), this type of turnover causes equal distribution in using financial services. Moreover, it increases the probability of financial corruption. It is about a decade that Blockchain technology has come into being. In this one decade, Blockchain has entered many fields and it might be said that the most important field is the financial systems. Most of the people identify Blockchain because of Bitcoin (and following it other cryptocurrencies); however, Blockchain acts beyond Bitcoin and it can create fundamental changes in many fields such as financial systems and it might remove the gaps in this field.

One of the interesting opinions regarding Blockchain is the machine economy; that is, Blockchain can move from the Internet of Things (IoT) to the economy of machines. Gartner, one of the largest research institutes in the field of information technology in the United States believes that IoT will cover more than 26 billion devices until 2019 and it will make an income amounting to $1.9 trillion. In order to develop such a structure, an Internet of Money cryptocurrency is needed to manage transactions among devices and on the other hand, micro-payments, per se, can lead to the creation of a new economy (Swan, 2015).

According to the predictions of Cisco, Machine to Machine (M2M) communications are growing with extraordinary speed and not only IPs' traffic has tripled from 2012 to 2018, it also is moving toward mobile, Wi-Fi and machine traffic. As the monetary economy leads to a better distribution of the resources among the people, this kind of machine economy can remove these problems at the level of machines (Swan, 2015).

The Challenges Ahead of Traditional Methods of Financial Transfers

According to the statistics and documents by Global Findex, about 1.7 billion people don't have access to the bank account. This issue is more in developing countries that don't have the necessary infrastructures. Some of the reasons that this number of people doesn't have the bank account is that they don't have enough money, the bank is very far away from them, they don't have enough documents to open the account, etc. On the one hand, many of those who don't have a bank account (about 62% of them) have low educational level. In order for people to use financial services, they should be familiar with financial literacy (Desjardins, 2019).

But the studies have shown that just one-third of the people have a correct understanding of financial concepts and these people often live in the developed countries. The main third challenge in this regard is that the people who gain access to the global financial services should benefit from fast and cheap services; however, most of the people have opposite experiences. This means that they pay high charges for the financial services while these services don't have enough speed. Currently, the average of 7% of trades volume are charged for the fees of financial transfers and the department of the UN sustainable development says that this figure should reach 3% until 2030. This figure will reach 10% for those who want to do financial transfers too and they sometimes have to wait for days in order for their transactions to be registered. The centralized financial system will increase the financial corruption too (Desjardins, 2019).

In most of the financial systems, the major part of the capital is owned by a small minority and it provokes inequality. Most of the people not only don't have much asset, they even don't have access to the financial services (such as loaning). Therefore, they even are not able to aggregate their wealth for themselves. Since the governments set the financial rules, tampering with the information related to the field of economy and financial services is common too. For instance, in Venezuela with printing money, the government tries to control inflation and it leads to more inflation per se. Finally, the most important challenge ahead of traditional financial systems is that the centralized systems are so powerful that their dissolution equals the dissolution of a large part of the body of the governments and its effects will be destructive on many fields.

Now, with the development of decentralized financial systems and the development of using cell phones and the internet, the challenges ahead can be removed through a technology such as Blockchain. But the main question which is raised is that "is the world ready for these changes?" The financial systems which have lower cost and higher performance will draw more trust in the future. The main factor which might cause the success of an idea might be its ability to draw the public's trust. Is Blockchain able to remove one of its main barriers; i.e. trust, or not?

1.2 What Solution Does Blockchain Have to Cope with These Challenges?

It is many years that the traditional methods of international transfer of money such as PayPal and Western Union have prevailed. But the centralized systems have high costs (just like the governments) and create many problems. Most of the people have been referring to the companies such as Western Union and PayPal for the international transfers of money and there was no safe alternative decentralized method.

Decrease of the Charges of Each Transaction

One of the most important reasons that some believe in Blockchain as the best alternative is to decrease the charges of financial transfers (Davidson, De Filippi & Potts, 2016), three main advantages of Blockchain which causes the decrease in its charges include:

Moore's law: the cost of processing digital information, e.g. processing speed, is halved every 18 months.

Kryder's law: the cost of storing digital information, e.g. the memory is halved every 12 months.

Nielsen's law, the cost of sending digital information, e.g. the bandwidth is halved every 24 months (Davidson, De Filippi & Potts, 2016).

Therefore, it can be stated that the charges of Blockchain-based financial systems is on a downward curve and this is a big competitive advantage for the Blockchain in comparison to other traditional methods. Of course, because of the effects of network and the charges related to switching, we expect that the graph of these charges to be non-linear. The other point which should be taken into account is that the cost of cryptocurrencies transfer includes mining too and this cost is sometimes high. Hence, it cannot be generally said that Blockchain lowers the costs of the transaction of every type of cryptocurrency (Davidson, De Filippi & Potts, 2016).

Does Blockchain Always Cause the Decrease in Charges?

Proof of Work, namely, PoW, is a schema based on the SHA-256 hash algorithm. It is used to create an encrypted hash. The average attempt of a processor to calculate PoW for each mined block is near zero. Bitcoin network does the testing, timing, and calculation of 2016 blocks which takes 1209600 seconds and 10 minutes is needed for each block (Antonopoulos, 2017). Although generating a block is done through a random process wherein a block or a number of blocks are found and processed at a specific time. In case the Bitcoin network understands that generating 2016 blocks takes less than 120900 seconds, it will increase hashing difficulty. On the contrary, if the time of generating blocks gets more, hashing will get easier. Therefore, the more the power of processors in the Blockchain network gets, the more the hashing difficulty will be. For instance, when the present paper was written the difficulty of calculations was 163491654904 while the first Bitcoin was generated with the difficulty of 1; that is, mining a Bitcoin is 164 billion times harder than mining a Bitcoin in the last decade. It can be concluded from all this information that the cost of mining Bitcoin is very high. According to the International Energy Agency, the annual electricity consumption is 3.38 TWh while in 2014 per capital consumption of the electricity has been 3.03 TWh in Jamaica with the population of 2.7 million. Therefore, as it was pointed out Blockchain can decrease the costs of financial transactions, on the contrary, the cost of mining Bitcoin (which is on a Blockchain network) is very high and this figure has an increasing trend opposite to the previous cases (Huckle & White, 2016).

Purposeful Investment for the Startups

Another example of the financial services which are in the revolution by the Blockchain is the crowdfunding. The idea behind it is that the peer-to-peer models can meet the needs of the startups to find an investor like Kickstarter to raise fund.

Kickstarter should have held some campaigns, but the platforms which are based on Blockchain remove the necessity of the presence of a middleman. The Blockchain-based fundraising platforms allow the startups to be able to raise fund for themselves via digital money; to put it another way, they can presell their cryptocurrencies.

Those who take part in these platforms will receive the tokens which show their share of that startup. One of the successful examples of this method is Swarm which succeeded in raising $1 million. This startup offered its product in 2014 and presold SwarmCoin to its investors. It succeeded in launching 5 other projects with the capital it had attained (Swan, 2015).

Facing Rent-seeking

In the challenges we encounter in the traditional financial systems, centralization is one of the important factors which cause creating these challenges. The nature of Blockchain is a decentralized network. Simple models of development in the current complex systems include changing from a centralized system to a decentralized one. Most of the systems were created with the centralized nature, since this method has an efficient structure for the regulation. On the one hand, it causes the creation of a transparent hierarchy and lowers the disagreements. But these features can cause power exploitation. In the economic systems, being centralized is the main factor in corruption and inflation and many of the systems prefer to move toward decentralized systems due to this reason. Just as being centralized can cause more regulation, being decentralized increases the system flexibility.

As it was mentioned in the section in the challenges ahead of traditional financial systems, most of the wealth in owned by few and the majority of the people are deprived of gaining access to such services and the wealth has been distributed unfairly among the people (Wright, 2018).

One of the capabilities of Blockchain is to combat rent-seeking. It might be said that being centralized is the main factor in rent-seeking for the financial and state systems. Rent-seeking refers to the people's attempt to raise their share of the existing wealth (e.g. the budget of a country) without making added value. Rent- seeking can finally lead to paralysis in the cycle of the economy and bring about a big dilemma for developing countries. Centralization needs trust, in case this trust is manipulated, it can cause rent. Since centrality causes manipulation of the trust, decentralization can be the solution for this problem, since trust is made by the cryptographic algorithm in these kinds of systems, so the political economy of Blockchain is a kind of private order competitive federalism, free entrance to one or some Blockchain means foot voting (foot voting is a theory in the field of election research wherein some people of the society announce their political opinion or idea not through traditional method of voting but through the presence or no presence in a specific place) that its main advantage is removing rent- seeking and removal of rent-seeking in this system is the result of removing a centralized systems (Davidson, De Filippi & Potts, 2016).

Controlling Financial Corruption

Blockchain makes a digital ledger of the transactions which cannot be tampered with and shares it with the users. Therefore, transparency is completely observed in Blockchain-based financial systems. One the one hand, the encryption causes these financial systems to be more secure than the traditional financial systems. Removing or altering the data of the transaction on the Blockchain network is almost impossible. Hence, it can be said that the Blockchain-based financial systems are very much resistant against financial corruption. But many people cannot accept this level of transparency and don't trust it. For example, using fake export accounts for illegal financial transfers out of china borders is very trouble- making. From April to September 2014, about $10 billion of transactions related to fake trades has been registered in China which all has resulted in occasional financial corruptions. The transparency of the trades in the Blockchain-based financial systems minimizes these corruptions (Kshetri & Voas, 2018)

Currently, the banks have problem in loaning with the security. Making sure about security qualification which is given by the loanee to the bank is hard and the possibility of circumventing the laws is there. The people's assets can be registered via smart contracts with Blockchain. These assets can include physical assets such as automobile or domicile or non-physical assets such as a person's share of a company. The information related to the people's assets is carefully registered in these smart contracts. For example, if the document of a domicile is held in a bank as the security, the owner of that domicile cannot use that document to loan from another bank anymore. Therefore, the process of qualification of the securities which the people to confide to the bank will get much simple and it will be possible for a process like loaning to become easier and more comfortable for the public (Kshetri & Voas, 2018).

With these explanations, it can be said that Blockchain can remove the challenges ahead of financial systems to a large extent with an acceptable approximation. Of course, traditional financial systems use their own unique methods for these challenges that most of the time increase the costs of the system. For example, for every international transaction in PayPal system can be to the maximum of $10,000, but there is not such a ceiling in Bitcoin. There are various opinions regarding the costs of the international transactions and every system should be compared to the other separately. Therefore, you cannot pass an absolute verdict about the fact that which method is better for the international money transfer.

In order for the financial systems to go toward using Blockchain, at first we need to have an all-in-one platform to solve all the mentioned challenges and on the other hand solve the problem of trust-making for the public. One of the problems which cause the people's distrust in using Blockchain-based financial systems is the instability in the value of cryptocurrencies. For instance, transferring a high amount of money to another country might bring about high costs, but you are sure that the value of your money is stable. But many of the cryptocurrencies don't have a fixed value and their value is defined according to the other factors and cannot be predicted.

The Problems Related to Double Spending of the Cryptocurrency

One of the first concerns of every cryptocurrency developer is how to avoid double-spending. Double spending means that a cryptocurrency is used more than once and there is inconsistency between the value of remained cryptocurrencies and the spent amount of cryptocurrencies. The cash does not have such problem. If you give $10 to buy a book, you cannot buy another ten-dollar book with that slip. But it is not the case in the world of cryptocurrencies. Suppose that you have one Bitcoin and you want to use it twice in two different transactions. So you send one Bitcoin to two separate wallet addresses. Both of these transactions will go the repertoire of unconfirmed transactions. The first transaction is confirmed by the mechanism unique to Bitcoin and is added to the block.

But the second transaction is not confirmed and recognized invalid. If both transactions enter the process of confirmation simultaneously, then the transaction which has the highest number of confirmation is added to the block and the other is deleted. The double-spending cryptocurrencies is avoided in this state, but there is another state too. Suppose that someone is in the destination of the second transaction (which has not been confirmed) doesn't receive the Bitcoin contract and it takes a while for him to understand it. Many of the buyers wait up to at least 6 transaction confirmations and then they almost make sure that the transaction has been valid. As you see there are still security holes in this mechanism that lead to the attack of the hackers and double spending of the cryptocurrency. For example, if a person holds 51% of the network power he/she can spend a cryptocurrency many times. Or he/she is very powerful, he/she can reverse the transaction and make a private Blockchain. Of course in the cryptocurrencies which have been created recently, these types of attacks have been controlled to a large extent and the developers always find new alternatives to solve these payment dilemmas in Blockchain.

1.3 The Challenges Related to the Business Model of Blockchain- based Financial Systemss

The nature of Blockchain is in such a way that perhaps the traditional methods of business are not appropriate for that. While this issue is one of the limitations of Blockchain, it has caused new business models. It seems in the first look that the business models are in contradiction with the concept of Blockchain since the purpose of a peer to peer model is to remove the middlemen and the costs related to it; however, some of business models that the organizations working in the field of the software and cloud computations use can be appropriate for the Bitcoin economy, for example, Red Hat model which is for developing the open- source software and SaaS business model. One of the things we are going to witness with the development of using Blockchain is the smart contract overseer, the one who controls the accuracy of what an Artificial Intelligence smart contract does and investigates if rewriting the smart contract has led to increase in its efficiency or not (Swan, 2015).

A financial system based on cryptocurrencies leads to an open business model for a big global scale. Most of the Blockchain software is open source and their APIs are accessible for the people. These Blockchain-based financial systems are often managed by open platforms and every user can make their own application on this platform. The traditional method of business model, like Netflix, Facebook and Instagram is somehow closed. The purpose of this business model is to maximize the number of users and the income and content creation will be increased consequently. The users can create new content on the traditional business models, but they cannot make any new program. Opposite to these models, the model Blockchain-based business models can adopt is to get the users engaged in this platform as much as possible in order to be able for it to lead to value creation and rewarding the users which itself can cause economic growth. As it was previously pointed out in the section of challenges, the unfair distribution of wealth among the people of the world has caused most of the people to use financial resources and make new wealth for themselves. But Blockchain-based business models give the opportunity to everyone to develop in this platform. For example, the people who do Bitcoin mining somehow make value in this platform and they themselves receive the reward for their job (Swan, Potts, Takagi, Witte & Tasca, 2019).

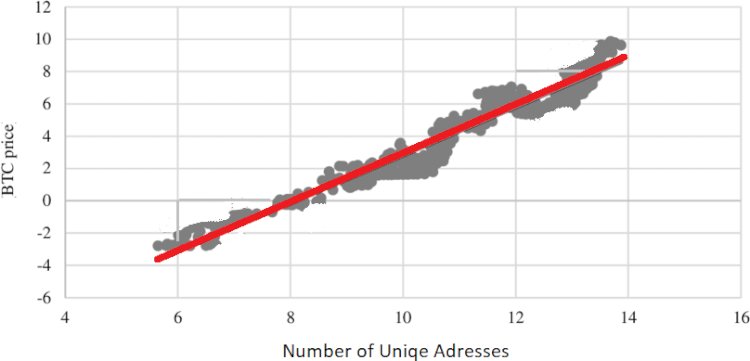

An intermediary point between closed platforms such as Netflix and open platform such as Ethereum is the App Stores. The users' applications can be bought and sold in these platforms and both the platform and the users benefit from that. In digital economies (either open or closed), the more the number of the users’ increases, the more the value of the network gets. In this regard, Metcalfe's Law says that the value of a network increases with the square of its users (n2). Figure 1 shows the degree of Bitcoin value taking the increase of the unique addresses (Pele & Mazurencu, 2019).

Figure 1. Metcalfe's law about Bitcoin shows that the degree of Bitcoin price increase has direct relationship with the square of the number of the users

The economists believe that the networks lead to the natural monopolies. Since everyone gradually understands that if they use one network, they will benefit more. For example, sometimes we see that large social networks are combined, but in the traditional business models, it leads to the rent-seeking and aggregating power in a system. For instance, the business cannot grow anymore in competition to the giants like Google and Facebook. On the contrary, Blockchain can avoid this phenomenon through making a reciprocal effect in the network; to put it another way, all the users get engaged in it and there is no monopoly for any organization. Reciprocal effects of the network are generally the feature of sharing economy and the Blockchain-based economy is located uniquely in this group (Swan, Potts, Takagi, Witte & Tasca, 2019).

One of the reasons that the reciprocal network works on the Blockchain economy is through bootstrapping. It is the value created by the development of new token projects without the users being forced to bootstrap a network. Because the Ethereum is an open platform for the Decentralized applications (DApps), a new token project can be created in this platform and opposite to the platforms such as Appstore, Ethereum does not receive any charge from you here; instead, it receives the charge for the calculation resources in gas form (Swan, Potts, Takagi, Witte & Tasca, 2019).

1.4 Outlook of Blockchain in Developing Financial Transfers

Understanding the value, strategy and effect Blockchain can have on this field needs a deep understanding of this issue that how a technology can be used and how its potentials can be applied. Blockchain is still a new subject and you cannot get successful unless you understand which strategies cause the Blockchain-based product to have durability.

The values Blockchain create in the long run are removing the middlemen while creating a safe infrastructure. The organizations benefit from lowering the transactions cost and more transparency as well as avoiding financial corruption using Blockchain. Economic motivations to achieve beneficial opportunities cause the companies to be willing to use Blockchain in their work.

Undoubtedly, the Blockchain project should be scalable, but without returning the capital in a short time, it will not be possible to continue working for a long time. What can be done to return the capital in a short time usually is that the companies presell a part of their shares. The Blockchain-based companies do it through ICO.

Brant Carson, senior digital analyst in McKinsey says that:

"Unstructured experimentation of Blockchain solutions without strategic evaluation of the value at stake or the feasibility of capturing it means that many companies will not see a return on their investments"

This is the mistake most of the companies made at the beginning of Blockchain emergence. The startups began working without considering their purpose in that project and their presupposed results and they didn't get to any result in the short time. Basically, most of the value Blockchain can create for a project is lowering the costs. Considering this issue, the scale of the project can be extended more easily.

For instance, in the financial field and transactions, the speed and decrease of the costs are the most important issues. Blockchain can remove these two problems. Therefore, considering this issue (and also the other challenges which we pointed out before), Blockchain can provide our needed benefit in the financial field and find a very larger scale in the far future through being legalized. Of course in the fields the decrease of the costs of the company is very important, using Blockchain in a short time will have more tangible benefit.

The short-term and long-term strategies should be specified in the beginning. The development of Blockchain can be difficult and costly and understanding the fact that how you are supposed to reach these strategies is of high importance. For example, for a company with works in the financial field, its short-term strategies can be selling more shares. Following it, creating a platform to change currencies to each other can be a short-term strategy. The long-term strategy of this company can be accelerating the transactions process. For example, there are currently limitations for the number of transactions per second. If the scale of the project is extended, this issue can make problems for the company and a solution should be found for that. The value of Blockchain will move from the challenges such as the decrease of the charges to the other direction and it will lead to the creation of new business models and income channels.

Finally, the long-term strategies a project should adopt in the financial field are its prevalence at the global scale and also becoming regularized. We will point out the alternatives proposed by the Counos Platform in this regard to cope with the problems and also the manner of using Blockchain advantages for the financial transfers.

2.1 Counos Platform and Its Function in Financial Transfers of Blockchain

Counos is an all-in-one platform including payment methods that offers its own unique cryptocurrencies. Counos faced this important idea in developing its operational development that a big volume of the global need for financial transfers with the lowest fee is felt every day more than before. There are 8 cryptocurrency models in Counos Platform. All these coin are traded on a peer- to-peer network. Counos uses Proof of Work, Proof of Identity and Proof of Stake algorithms. Counos platform is decentralized, but it is composed of a professional team that makes using its services easier for the users. Counos tries to develop an all-in-one Blockchain-based financial platform. This platform is able to meet all the users' needs for financial transfers. Through offering stabelcoins such as Counos Cash (equal to 20 Swiss francs), Counos U (equal to 100 U.S. dollars), Counos E (equal to 100 euros) and Counos CAD (equal to 100 Canadian dollars), Counos covers a wide range of the financial needs considering different financial origins. From the one hand, through offering a decentralized exchange (DEX), Counos provides the possibility of changing cryptocurrencies to fiat money and vice versa for every user all around the world. In fact, with aggregating all the financial services such as offering cryptocurrencies, trading cryptocurrencies, and the payment gateway, Counos can act like Western Union or PayPal, the only difference is that in addition to very low fee, the users can meet their financial needs in an extensive financial network (Jain, 2019). It was attempted to get together all the services related to transactions while the created powerful and fixed platform enjoys sufficient resilience.

2.2 Which type of consensus does Counos use?

As we told before, Counos uses the Proof of Work, Proof of Identity and Proof of Stake consensuses. There is the possibility of facing 51% attacks in most of the Blockchain-based networks which is generally because in case a large volume of the network is held by the miners, Proof of Work consensus changes into a security hole. But in Counos the possibility of the attacks will be controllable by combining these three algorithms. There are many discussions in that which the algorithm of consensus is more appropriate. Proof of Work algorithm has a high calculation cost due to the mining process. In this algorithm, a reward is given to each miner which can do the calculations related to each block. Miners of the network try to be the first to solve these calculations. But in the algorithm of the proof of stake, the one who has the greatest asset will surely be selected for the mining. There is no reward in this system, but the miners receive a cost for the mining. The currencies which are mined through it can be financially very much economic than the other methods.

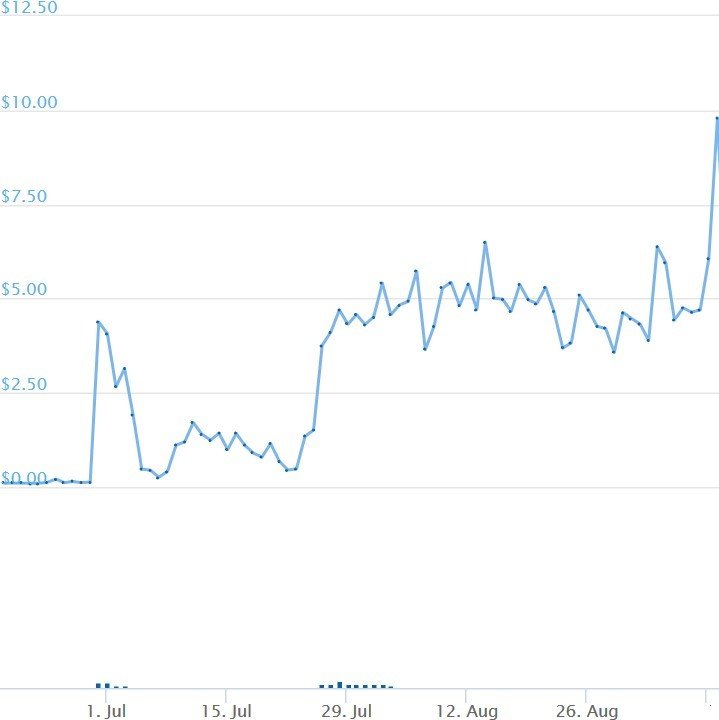

Although the Counos platform has recently entered the global market, it has been able to reach the volume of its trades to an acceptable level. Counos coin is the first cryptocurrency platform that although it doesn't have such function as stablecoins, it has succeeded in growing ideally through public offering to the users. (Figure 2)

Figure 2. The process of the growth of Counos Coin price with the increase in the number of users

As it was mentioned in Metcalfe's law, with the increase of the trades' volume and the number of users, the rising growth of the price of cryptocurrencies will be created. But the main question is that "which advantages does the increase of the number of the users have for the increase of the level of transfers in the field of Blockchain for Counos Platform?" The increase of the volume of users' trades can lead to the development of the trades in Counos Platform and consequently the increase of interest in Counos DEX. With offering stablecoins, Counos has succeeded in functionally extending the field of financial trades in Blockchain technology as the base in trading fiat money.

Cryptocurrencies Based on Precious Metals

The possibility of developing cryptocurrencies based on precious metals has always been challenging. Offering cryptocurrencies based on Paxos gold has been very controversial (Roberts, 2019); however, Counos has been seeking for filling the gap in the field of transfer of digital assets all across the world. The global trades in the field of precious metals are very disputing. Its main reason is different and various rules of the countries in the field of trading precious metals. But transferring precious metals has always been one of the serious economic needs of many countries of the world (Amadeo, 2019). In addition to transfers, considering the continuous growth of the price of a global ounce of gold and other precious metals, attending to buying them as the stable investment has always drawn many people's attention.

Blockchain technology provides us an appropriate potential in this regard. Counos intends to provide the users with the possibility of investment in the market of gold without the risks such as physical robbery through offering two cryptocurrencies based on precious metals under the names "Counos Gold" and "Counos Silver" in addition to paving the way for trading precious metals around the world. Each Counos Gold equals to one gram of Swiss standard gold.

Analysis of Counos Business Model

What value Does Counos Platform Make?

A big issue in the field of cryptocurrencies that cause an inability in creating their business model well is that cryptocurrencies don't have stable value, so the people distrust them. One the one hand, some believe that cryptocurrencies are controlled by a class of people who have the greatest share of that cryptocurrency and in fact, the market of cryptocurrencies is sometimes directed by these people. Although cryptocurrencies have been made as an infrastructure to do international financial trades (which make the trades cheaper and faster), this issue caused them to be far away from their main purpose. Counos used stable coins to solve this problem. These coins including Counos E, Counos Cash, Counos U, and Counos CAD have a stable value.

Therefore, the common businesses and people can transfer their money using these coins or even save them in their wallets while they don't worry about its value change. Stable coins have in fact been designed for this purpose that the people face the least loss as a result of value change in cryptocurrencies. These coins are capable of being changed into the other currencies and cryptocurrencies. Counos platform has offered a comprehensive solution for financial transfers, for example after you transfer your coins to another account and the other account beneficiary wants to change his/her money to another unit (e.g. dollar), he/she can do it via Counos DEX; that is, Counos is a collection of services which helps the users in almost every stage to do their financial transactions. The users can change both Counos coins and even the other cryptocurrencies to each other through this exchange. In addition to all these tasks, Counos has developed other platforms too, payments based on cryptocurrencies, centralized exchange and recently an instant messenger such as WeChat are some cases in point via the last one the people can trade their cryptocurrencies easily. There has been no Blockchain-based platform until Counos to suggest a comprehensive solution for the financial services.

How Does Counos Make This Value?

As we pointed out, the Counos platform has succeeded in attaining a good value in a short time through creating many various infrastructures for the financial transactions.

How Does Counos Platform Change This Value into Money?

A part of this task is carried out by those decentralized exchanges which were mentioned before. Moreover, Counos has generated income through buying and selling instable coins. For example, Counos coin and Counos X are two instable coins in the Counos platform which don't have a fixed value like Bitcoin and they can be used for the investment. The other job of Counos is supplying its stock. It means that a large part of its coins (about 18 million) are given to the people freely. It can cause entering a large proportion of the users in this platform and provides its future benefit through increasing its users and also offers new services.

What Does Counos Platform Do to Abide?

It might be said that the most important thing which cause the persistence of Counos is being all-in-one. Besides offering comprehensive services to the users, Counos is always updating these services. For example, the application we explained before is one of the services which will be released soon. Therefore, it can be said that Counos has a bright future.

A mix of some algorithms of consensus has been used in Counos network; that is, Counos is in a way that the miners get rewarded as per every block they make. But Counos has limited the possibility of benefiting for the miners through making a newer stage. The other difference Counos has with the other systems is that each coin should receive 100 confirmations to be set free; otherwise, it will be stayed in the users' wallet and the user cannot use it. In order to avoid mining by anybody in the Counos network, Counos has offered a different solution.

In order for the miners to be able to mine, they should be confirmed at first by the system. It means that the one who wants to create a trust node should be confirmed in the system at first and it should be specified that to whom the node is belonged. Then he/she is changed into a trust node and can mine.

The other type of miners is those who get the whole reward and they should have at least 500000 coins in their wallet to be able to receive the whole reward. It means that we have two types of miners in the Counos network: verified miner and trust miner. Trust miner is actually the person who gets rewarded both from the blocks and transactions (in case he/she has at least 500000 coins in his/her wallet, it is somehow is a proof of stake). Proof of Identity means that the miners which are busy mining will have a thing like digital signature and no one can use the wallet which is not connected to the network and the Proof of Identity can be created through this digital signature. Moreover, it is investigated once per 100 confirmations in order for anyone not to be able to change it and the coin cannot be spent until the time it reaches 100000 confirmations. 51% attack will be counteracted through it in this way too.

Counos Network Scalability

The problems of the transactions which are in Blockchain will be removed in the Counos network to a large extent. Counos has used the latest Litecoin code sources and extended and developed it. The number of transactions that can be done in the Counos network is equal to the number of inputs and outputs of the coins of a wallet. The limitation in its scale is similar to that of Litecoin.

One of the reasons of using this system is protecting the network. Since if the network is fully open, the possibility of attacking to it will get high, but the proof of Stake and the Proof of Identity avoid these attacks. One of the attacks to the nature of Bitcoin is that Bitcoin is not really a decentralized network since anyone who has more miners can control the network and do a 51% attack. This means that more power and money lead to controlling the network. The majority of transactions (40%) are done in about 1000 wallets in the Bitcoin network (Kharif, 2017) and it means that the decentralization of the Bitcoin network is different from the purpose Bitcoin had at first in practice.

Blockchain Teachings

Although I had been familiar with the concepts of Blockchain so far, the end of this course that I have found the experience of writing different papers, it bestowed me a richer understanding of the extensive effects of Blockchain and also its mechanisms and of course its business models.

Blockchain is something beyond Bitcoin and its influences should be sought in wide fields like financial transfers. The current status of Blockchain is very much similar to the advent of the internet in the nineties when most of the companies suddenly invested in a newly-emerged technology and many of those companies got very successful while some of them don't exist now.

Presently many of the big companies are searching on Blockchain in order to understand how it can be used in their business. So, it might be said that Blockchain has still a long way ahead of it to be accepted by the public. Blockchain is just a far-fetching dream for some and it is a huge evolution in technology for the others which will alter everyone's life. But in my opinion, Blockchain will help the people to live in a more equal condition. The states should include Blockchain in their system in order for the people to trust more in Blockchain through it. But the question which is raised for me is that whether a system with a centralized basis can benefit against a system that is completely across from it. So I think that the Blockchain will have a bright future but not for all the businesses.

The methods of financial transfers in the traditional manner are slow and costly, because when some currencies should be changed into each other, more than one bank should be included and it causes not having high speed in transactions. Of course, the other fast methods of international financial transfers are expensive. Blockchain and cryptocurrencies can lower this cost. In some of these traditional methods of international transaction, sometimes up to 20% of the total amount of money will be spent for this transaction fee. Blockchain can decrease this fee to 2%. But this point should be taken into account that currently the number of transactions Blockchain does per second is very limited and if Blockchain is set not be used in extensive aspects, it might not meet everyone's need.

It seems now that Blockchain has entered many fields and every day we observe its other applications, but in order for all these innovations to boom, Blockchain needs something more than these. Blockchain should be definable in a standard global model like internet protocols, to be able to better gain the public's trust. The challenge ahead of Blockchain is that how Blockchain can be made usable for all? For example, how the digital wallets can become available for everyone to benefit from? The processes related to the turnover of cryptocurrencies and Blockchain are of high importance. For instance, most of the people don't know what mining means! Therefore, the existence of a global standard greatly helps this industry to be accepted in the public.

In addition, offering more comprehensive and simpler definitions will help more acceptance of Blockchain. Perhaps in a foreseeable future, a solution will be found for this too, but it can be said that the people's access to the internet gets more and more in time. Hence, it is not very strange that one day the financial transfers are carried out in the infrastructure of Blockchain or the cryptocurrencies replace the currencies of the countries. The giants of banking and the financial industry still prefer their traditional methods, but new companies test new methods every day. Many of the industries can be altered via Blockchain, especially in the industries of finance and the supply chain. But there is no single answer which includes Blockchain solution for all these businesses. For example, Blockchain can be managed publicly, privately or by an organization. Moreover, everyone might gain access to this network or just the verified people are able to use it. Therefore, there are many methods. These methods are designed based on the need of the system. Although there are many criticisms in this regard, many people believe that the nature of Blockchain is in contradiction to being private.

With all these challenges ahead of Blockchain there is still a key question that if Blockchain finds an answer for that, you can be more hopeful about its future. Can Blockchain gain the public's trust or not?

Can Blockchain Make Trust?

There are many opinions about this question. In the opinion of some people, Blockchain has actually improved the concept of trust. Some others believe that Blockchain is not trustable. For Satoshi Nakamoto generating Bitcoin was easy, but it is hard to reach a peer-to-peer cryptocurrency to the level of the people's expectations. The presence of an organization like the government, attorneys, or the banks, etc. which make this trust is necessary, they can facilitate the process of transactions and the parties will no more need to rely on transactions being trustable or not. What Blockchain does is removing these middlemen, but how can it make trust? (Blasingame, 2019)

Due to its distributed nature, Blockchain becomes a more powerful rival for these middlemen. The documents which are registered in the traditional manner can be changed or they might even be removed in time, but it is not the case in Blockchain and the data (financially and the others) are immutable and the network is managed by the miners. It might still be soon to say that Blockchain will alter the concept of trust in the future. The trust is taken from the middleman and it is formed between every user. In fact, "trust" has various concepts. We might not know a person, but we can be sure about his/her future behaviors. For instance, we don't know the miners, but we know that they use the mining protocols to continue network survival.

Kevin Werbach wrote a book in 2008 under the name of "Blockchain and the new architecture of trust" where he spoke about 4 different types of trust architecture. The first is the peer-to-peer trust. This type of trust is more based on morale; that is, some people trust each other. The second is organizational trust. The people cannot trust each other and they don't accept to get engaged in negotiation with each other. Therefore, the people need a supervising agency. Here both parties trust the state and rules. For example, the credit cards have been made based on this type of trust that they allow unreliable buyers and sellers to interact with each other. The other type of this trust is the distributed trust. This type of trust exists especially in the security system unique to Blockchain. What Blockchain does about the issue of trust is that it takes the trust from the institutes and people and delegates it to the technology and you can fully trust these technologies, since your only fulcrum is technology. If we look at the issue of trust rigidly it can be said that Blockchain doesn't solve the problem of trust correctly and leaves many unanswered questions. But its advantages cannot be ignored (Werbach, 2018).

One of the other controversial issues in Blockchain is being centralized or decentralized. Basically, there has been no infrastructure except the internet to direct different fields toward decentralization in this large scale. The proponents and opponents of each one have their own advantages. For example, some believe that total decentralization never leads to the success.

Conclusion

Blockchain has been created to make a fundamental change in the financial transfers. Considering its various potentials, Blockchain can be a very appropriate infrastructure for the international transfer of digital money and assets. The traditional systems of financial transfers have lagged behind the fast process of financial needs considering centralization and lack of transparency and of course creating cumbersome bureaucracies. Considering its decentralized and clear structure, Blockchain has dramatic positive consequences for the financial transfers. Transparency in financial payments and transactions, transfers with appropriate speed, the increase of trust level in payment system considering the decisiveness of transactions and of course the decrease of probability of occurring financial frauds taking the decentralized structure of Blockchain is among the positive consequences of Blockchain technology. Taking all these advantages, Blockchain shows its drawbacks in payment systems. Through developing and updating a stable network, these drawbacks can be removed in time. Regarding financial payments, valid cryptocurrencies of the global markets have distanced from their main innovative reasons. Due to the instability of the value of cryptocurrencies, the process of financial transfers through using them is very challenging. On the one hand, lack of the existence of a comprehensive financial system that guarantees cash change of cryptocurrencies and using them for financial payments in addition of offering them has created a dramatic vacancy in the Blockchain-based systems. Counos platform has been developed to fill this vacancy. Through offering stabelcoins and decentralized exchanges, Counos has provided the possibility of changing it to different kinds of cryptocurrencies or fiat money besides offering a wide variety of cryptocurrencies to transfer asset all around the world.

It seems that a growing future will face using Blockchain technology for financial transfers. Even the banks such as the Bank of America and the transfer systems such as PayPal, too, have become aware of this issue and due to this reason, they attempt to remove their drawbacks using Blockchain technology.

There is still an important issue despite all these points. Blockchain technology, like any other emerging technology in the human history, is rejected by the traditional powers and there is resistance against it. It might be pointed out the biggest dilemma of Blockchain technology is trust, if the trust in this technology is attended to considering introducing its advantages realistically in comparison to traditional payment methods, you can be hopeful that Blockchain technology will be changed into an Internet of Money more than any other time in the near future.

Annex

Business Model Canvas of Counos Platform

References

• Amadeo, K. (2019), History of the Gold Standard, TheBalance, viewed 16 December 2019, .

• Antonopoulos, A. (2017), Mastering Bitcoin, O'Reilly Media, June 2017, 2nd Edition, pp. 21-37.

• Blasingame, J. (2019), Blockchain Isn't the End of Trust, It's The Future of Trust, Forbes, viewed 17 December 2019,

.

• Cridland, T. (2018), Can We Stop the Likes of Amazon, Paypal and Facebook from Monopolising Almost Everything That We Do Online, HuffPost, viewed 11 December 2019,

.

• Davidson, S., De Filippi, P. and Potts, J. (2016), Economics of Blockchain, Available from: SSRN [12 December 2019].

• Desjardins, F. (2019), The 7 Major Flaws of the Global Financial System, VisualCapitalist, viewed 12 December 2019,

.

• Felsenthal, M. and Hahn, R. (2018), Financial Inclusion on the Rise, But Gaps Remain, Global Findex Database Shows, The World Bank Working for a World Free of Poverty, viewed 10 December 2019,

.

• Huang, R. (2018), Cryptocurrency Would Fix Money Transfer Markets If More People Were Familiar with It, Forbes, viewed 9 December 2019,

.

• Huckle, S. and White, M. (2016), Socialism and the Blockchain, Future Internet, Available from: SemanticScholar [13 December 2019].

• Jain, S. (2019), Counos aims to conquer the fintech landscape by solving every crypto need in one single platform, Medium, viewed 15 December 2019,

fintech-landscape-by-solving-every-crypto-need-in-one-single-platform- c94577a43812>.

• Kharif, O. (2017), The Bitcoin Whales: 1,000 People Who Own 40 Percent of the Market, Bloomberg, viewed 17 December 2019,

.

• Kshetri, N. and Voas, J. (2018), Blockchain in Developing Countries, IT Professional, Volume: 20, Issue: 2, Mar./Apr. 2018, pp. 11-14.

• Mulders, M. (2019), Blockchain — 7 Benefits for the Financial Industry, Hackernoon, .

• Pele, D. and Mazurencu, M. (2019), Metcalfe's law and log-period power laws in the cryptocurrencies market, Economics E-Journal, May 2019, pp. 5-21.

• Roberts, J. (2019), Crypto or Gold? Paxos Offers Both with First Gold- Backed Token, Fortune, .

• Saigal, K. (2019), Trade Finance’s Blockchain Dreams Still Far from Reality, Euromoney, viewed 10 December 2019,

.

• Schueffel, P., Groeneweg, N. and Rico, B. (2019), The Crypto Encyclopedia: Coins, Tokens and Digital Assets from A to Z, Growth Publisher, Available from: Researchgate [9 December 2019].

• Swan, M. (2015), Blockchain: Blueprint for a New Economy, O'Reilly Media, February 2015, First Edition, pp. 5-85.

• Swan, M., Potts, J., Takagi, S., Witte, F. and Tasca, P. (2019), Blockchain Economics: Implications of Distributed Ledgers - Markets, Communications Networks, And Algorithmic Reality, World Scientific Europe, pp. 3-23.

• Tapscott, D. (2016), How blockchains could change the world, Mckinsey, viewed 9 December 2019,

.

• Werbach, K. (2018), The Blockchain and the New Architecture of Trust, The MIT Press, pp. 25-37.

• Wright, C. (2018), Rent-seeking in economics and crypto, Medium, viewed 12 December 2019, .

Written by:

Dr. Pooyan Ghamari

https://www.linkedin.com/in/counos/

www.counos.io